The Animal Risk Matrix: How to Spot, Prioritize, and Manage Risks Like a Pro

Risk Management Lessons From the Wild

In this issue:

The Elephant in the Room: The Risk Everyone Sees but Ignores

The Black Swan: The Rare, High-Impact Risk

The Gray Rhino: The High-Probability Risk That Leaders Ignore

The Black Jellyfish: The Rare but Predictable Risk

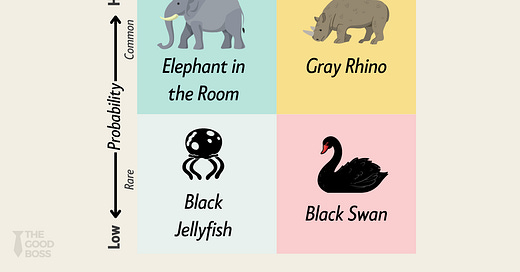

The Animal Risk Matrix

Applying the Animal Risk Matrix

The 4 Steps to Risk Management

Common Mistakes to Avoid

Download the Animal Risk Matrix Worksheet (free for paid subscribers)

References

Final Thoughts

✨

“Success is about smart risk management, not about wild risk taking.” — Michael Masterson

Every day, I take risks.

When I step into my car, I risk an accident. When I launch a product, I risk failure.

Some risks are predictable, while others come out of nowhere. Some risks are slow-moving threats that you see coming but ignore.

As a leader, how do you decide which risks to tackle first?

Risk management isn’t just for Wall Street traders or insurance companies. It’s at the core of leadership. Whether you’re navigating a market downturn, making hiring decisions, or launching a new initiative, the ability to manage risk effectively can be the differentiator between success and failure.

In this article, I will discuss the Animal Risk Matrix, which derives lessons from animal metaphors. These metaphors will help you build your risk management muscle, and become more effective as a leader.

The Elephant in the Room: The Risk Everyone Sees but Ignores

Mr. Thompson — the CEO of a top technology firm — was a smart, confident and aggressive leader. In financial terms, his company was doing well, and he was proud of how he had led the company through difficult times.

Yet, inside the organization, employees were frustrated. The culture had turned toxic. Infighting was common, workloads were unsustainable, and top talent was quietly leaving.

Inside the facade of the swanky office building, there lurked a giant elephant. The elephant would follow Mr. Thompson around, and everyone in the senior leadership meetings could see the elephant in the room, yet nobody seemed to notice it.

The elephant in the room is a metaphor that represents:

The obvious and imminent problems or risks faced by a company, yet nobody dares to bring the issue up.

In the above example, the elephant in the room represents the employee morale issues that needed urgent attention, yet the leadership chose to ignore them. Why? Because they were uncomfortable. Addressing them meant facing difficult conversations, challenging long-held assumptions, or admitting past mistakes.

As leaders, we see elephants in every room we enter. What differentiates good leaders from great leaders is how they handle these elephants.

How to Handle the Elephant in the Room

Call it out early. Imagine you are a child, and you spot an elephant in the room - wouldn’t you call it out instantly? Leave aside your “grown-up” inhibitions for a moment, and call out the elephant as you spot it. The longer it lingers, the bigger it gets. It’s akin to a dangerous illness or disease: the sooner you diagnose it, the less painful it is.

Encourage psychological safety. Create an environment where your teams feel comfortable raising difficult issues. Make it easy for them to call out the elephants in the rooms.

Make it a part of the process: I once worked for a leader who had “The Elephant in the Room” as the first topic in every leadership meeting. Having this part of the agenda made it less daunting to call out the issues. It was part of the process and expected.

What elephants are lurking in your organization? Let us know in the comments below. 👇

The Black Swan: The Rare, High-Impact Risk

In 1697, Dutch explorers in Australia discovered something that was thought to be impossible—a black swan. Up until that moment, Europeans had only ever seen white swans and assumed that all swans were white.

This metaphor inspired The Black Swan Theory by Nassim Nicholas Taleb, a Labenese-American risk analyst.

The black swan theory is a metaphor that describes:

A rare, unpredictable event that has massive consequences.

Examples of Black Swan Events:

The 2008 Financial Crisis—almost no one saw it coming, yet it reshaped the global economy.

The COVID-19 Pandemic—a rare event that disrupted supply chains, healthcare, and entire industries overnight.

The Rise of AI—a technological shift that is now fundamentally changing industries in ways few predicted.

How to Handle Black Swans

Accept that they will happen. By their very nature, you can’t predict black swan events, but you can build resilience.

Stress-test your organization. What would happen if your organization did face a black swan event? What if your biggest customer left? If a competitor launched a game-changing product? Would you organization be able to handle it?

Diversify your risk. Don’t put all your eggs in one basket—whether it’s relying too much on a single revenue stream or a key employee.

Black Swans are rare but they’re inevitable, so the question is: Are you prepared to handle them when they arrive? Let us know in the comments. 👇

The Gray Rhino: The High-Probability Risk That Leaders Ignore

While Black Swans are rare and unpredictable, Gray Rhinos are risks that we can see coming—but still fail to act on.

I grew up in Tanzania, where I frequently saw rhinos grazing on the savanna. These animals are impossible to miss. Yet, if you're not paying attention, one could charge at you unexpectedly.

You may have a two-ton, horny thing coming right at you, and you may not see it.

The term Gray Rhino was coined by Michele Wucker, an American author and policy analyst, to describe:

A highly probable risk that is obvious and visible, yet often ignored or underestimated until it’s too late.

The metaphor is used to highlight that so many of the things that go wrong in business, in policy, and in our personal lives are actually avoidable. We don’t pay attention to the problems, while knowing all along that they are there.

Examples of Gray Rhinos:

Climate change—scientists have warned about it for decades, yet governments and corporations have been slow to act.

Cybersecurity threats—companies know they need better security, but many wait until a breach happens.

A toxic workplace culture—we’ve all seen this: poor employee engagement, high turnover, and declining morale are all warning signs, yet many leaders ignore them.

How to Handle Gray Rhinos

Maintain a “Gray Rhino Checklist”. List down threats and risks that your organization faces, and create a strategy to handle them. You know the gray rhinos are out there—you just don’t know when they will show up.

Create a proactive plan. Don’t wait for the crisis to hit—anticipate it and mitigate it early.

Hold yourself accountable. If you’ve been avoiding an obvious problem, ask yourself: Why? This could unravel blindspots in your own leadership.

What’s the Gray Rhino charging toward your business right now? Drop it in the comments below. 👇

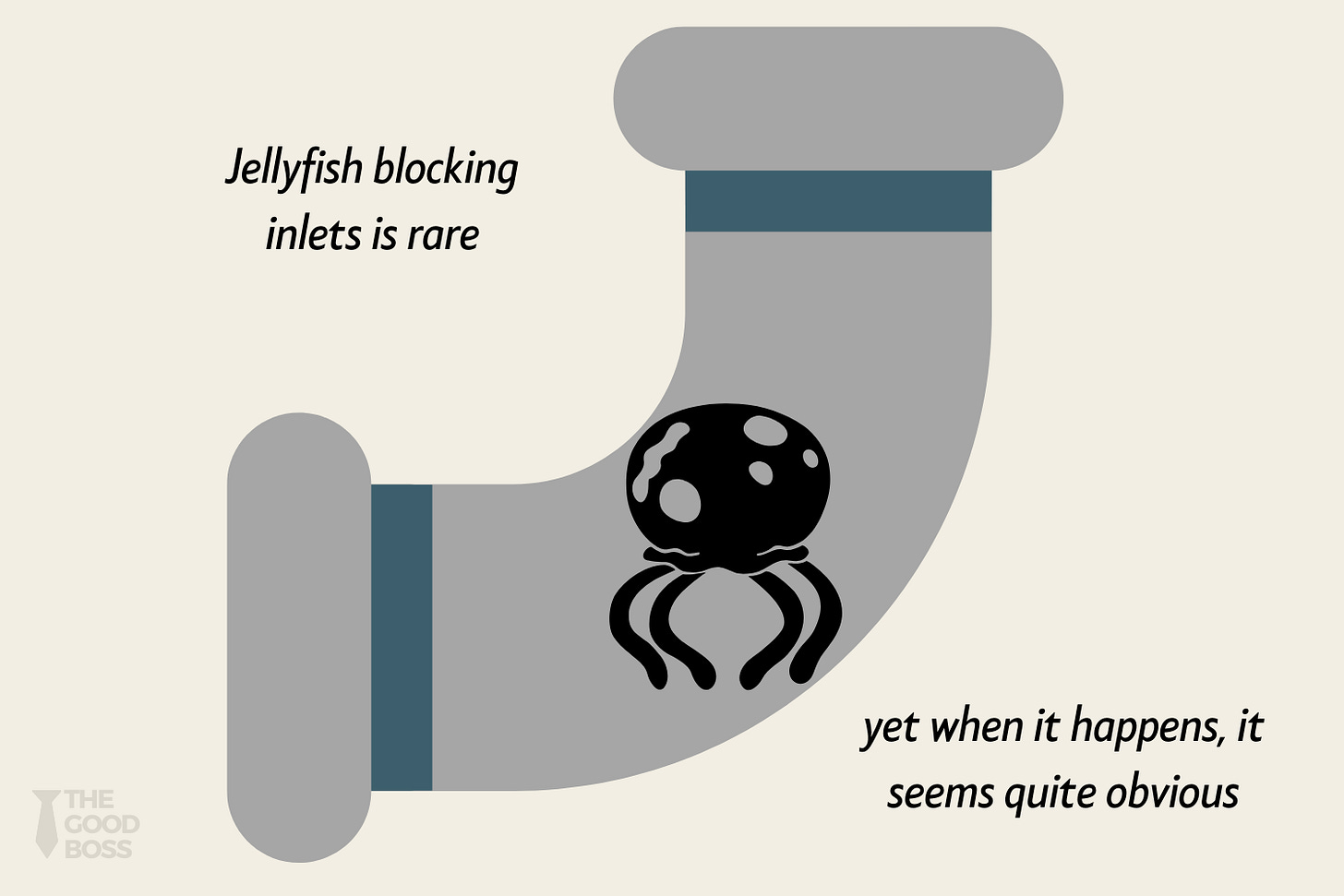

The Black Jellyfish: The Rare but Predictable Risk

In 2011, a nuclear power plant in Japan had to shut down—not because of an earthquake or tsunami, but because jellyfish clogged the cooling water intake.

This wasn’t a one-time incident. Similar shutdowns have happened in Sweden, US, and Scotland. In all these incidents, it was found that rising temperatures due to climate change created favorable conditions for the jellyfish populations to increase rapidly. Who could have imagined?

This is a Black Jellyfish risk:

A predictable event that is often ignored because it’s rare.

Unlike Black Swans, we can anticipate these risks, yet because they happen infrequently, they often don’t get the attention they deserve.

Examples of Black Jellyfish Risks:

Regulatory changes—new laws that could impact your business might not happen often, but they’re entirely foreseeable.

Vendor failures—if your supply chain relies on a single key supplier, their failure could disrupt everything. They could be working smoothly for a long time, until they do.

Unexpected leadership departures—we hear about this in the news all the time, but it’s often in the context of “other” companies. What if your CEO resigns unexpectedly - does your company have a succession plan?

How to Handle Black Jellyfish Risks

Identify predictable but rare risks in your business. If it has happened in your industry before, it could happen again, and it could happen to you.

Have contingency plans. Just because it’s rare doesn’t mean you shouldn’t be prepared.

Monitor external signals. If similar risks have impacted competitors, learn from their mistakes. Don’t wait for your own company to be hitting the headlines.

Black Jellyfish risks might not be urgent today, but ignoring them could be costly in the future.

Can you identify any Black Jellyfish risks in your organization? Let us know in the comments below. 👇

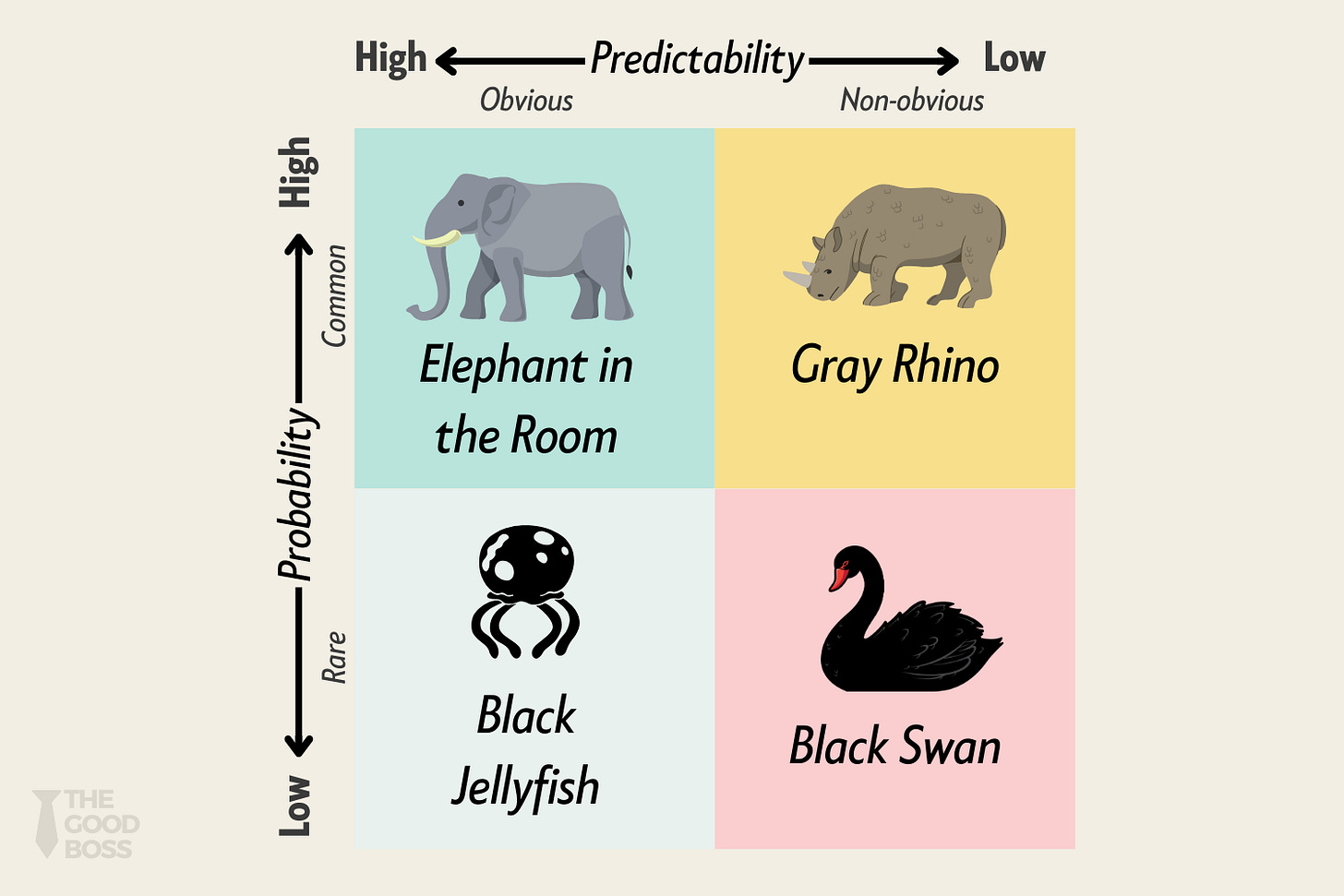

The Animal Risk Matrix

Risks come in different shapes and sizes, and as a leader, you are faced with a variety of risks. Some risks are obvious, some are rare, while others are hard to predict.

Now it’s time to put together the four animal-inspired risks into a framework I call the Animal Risk Matrix:

The Animal Risk Matrix is a matrix that plots the Predictability vs Probability of risks you face in your business.

As you plot your risks in the matrix, you will be able to associate your risks with one of the following animal metaphors:

Elephant in the Room: These are risks that are looking at you in the eyes, yet nobody wants to talk about them. As a leader, you should be taking these head-on, and making sure that there are no lurking elephants under your watch.

Black Swans: These are high-impact risks that are very rare and hard to predict. They can come in suddenly, and hit hard. As a leader, you need to build a robust strategy that can withstand the onslaught of these risks, when they do hit.

Gray Rhinos: These are high-impact risks that are highly probable, yet hard to predict. As a leader, you should account for these risks given their occurrence, and have a strategy to handle them so they don’t turn into black swans.

Black Jellyfish: These risks are predictable and easy to explain, yet they are rare. As a leader, you need to make sure your risk management strategy accounts for these, and build the guardrails to avoid them where possible.

When you are faced with a risk, ask yourself the question:

Is this a Black Swan, a Gray Rhino, a Black Jellyfish or an Elephant in the Room?

❤️ Enjoying the read? Subscribe to The Good Boss to get articles like this every week.

Applying the Animal Risk Matrix

The Animal Risk Matrix is a powerful tool, but it only works if you apply it effectively. Knowing that risks exist isn’t enough—you need a system to evaluate, categorize, and act on them.

Next, we will:

Review the simple 4-step approach to identifying, categorizing, and mitigating the various types of risks you will face as a leader

Review common mistakes you should avoid while using this model

Put the power of this model into practice with the Animal Risk Matrix worksheet, which includes step-by-step prompts to guide you through the application process (note: paid subscribers enjoy FREE access to the entire collection of worksheets!)

Review additional resources to further your understanding

Close out with some key takeaways

Let’s dive in. 🚀